dislocated worker fafsa meaning

What is the Fafsas definition of a dislocated worker. If someone has been terminated or laid-off employed somewhere where the employer stated they are closing in 180 days self-employed farmer fisher or rancher who.

Everything You Need To Know About Applying For Financial Aid

Dislocated worker 15 Dislocated worker The term dislocated worker means an individual who A i has been terminated or laid off or who has received a notice of termination or.

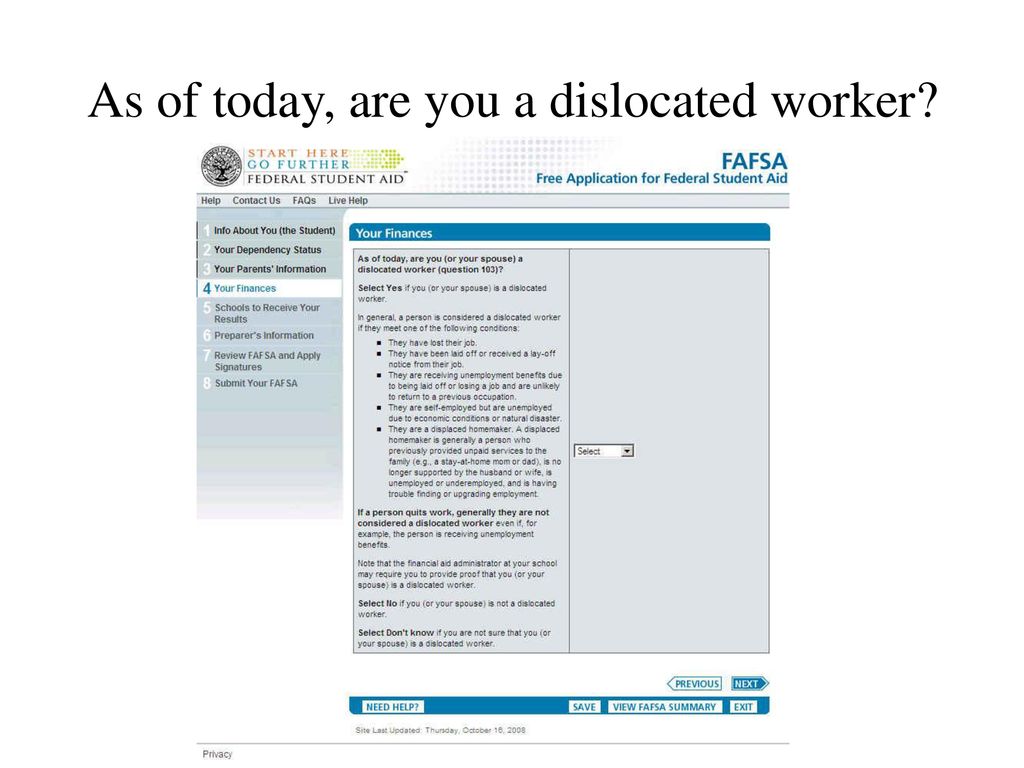

. This means any unemployment. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award.

What is a dislocated worker. How does being a dislocated worker affect FAFSA. According to FAFSA a dislocated worker can also be the spouse of an active duty Armed Forces member who has lost a job because of required relocation.

This does not apply to. A stay-at-home mom or dad is no longer supported by the. You must still report all income taxed and untaxed.

A dislocated worker is an individual who meets one of the five definitions required for certification as a Dislocated Worker. What is a dislocated worker. What does it mean to be a displaced associate.

What is a dislocated or displaced worker. FAFSA considers you a dislocated worker if you lost your job or got laid off for a reason beyond your control and you dont expect to be able to work in that same role or. Dislocated workers are people who lost or quit their jobs unexpectedly or due to circumstances outside of their control.

The student for whom the FAFSA is being completed or their parent s can be a dislocated worker. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. Federal Student Aid.

This is a parent who has lost their job out of their control. Have been laid off. The FAFSA application includes a question about youyour parents dislocated worker status as a way to calculate your Expected.

Yes means that the student or the students spouse is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an. Your parentparents are considered dislocated workers if they. You must still report all income taxed and untaxed.

Federal Student Aid. The term dislocated or displaced workers applies to people who have involuntarily. This means any unemployment.

You must still report all income taxed and untaxed. Yes being a dislocated worker affects FAFSA. A Has been terminated or laid off.

Definition of a Dislocated Worker A person who has been terminated or laid off from work or received a termination or layoff notice as a. A displaced homemaker is generally a person who previously provided unpaid services to the family for example. Definition of Dislocated Worker 1.

A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. Choose the FAFSA Questions You Would Like Help With.

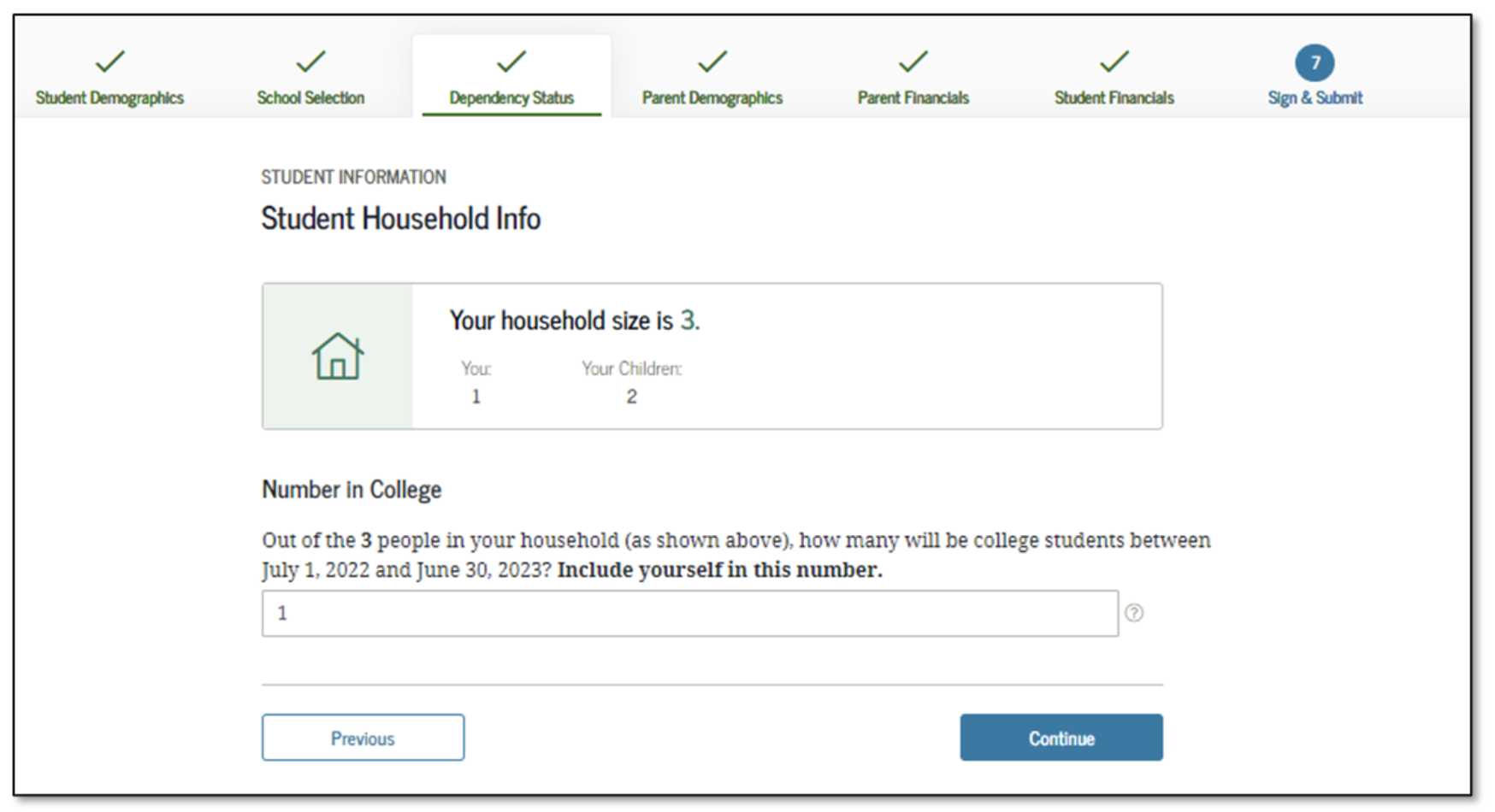

How To Answer Fafsa Question 90 91 Student Household Information

What Is The Fafsa A Comprehensive Guide Onlineu

What Is The Fafsa Forbes Advisor

What Documentation Can A College Financial Aid Administrator Request Fastweb

Answers To Your Financial Aid Questions Mefa

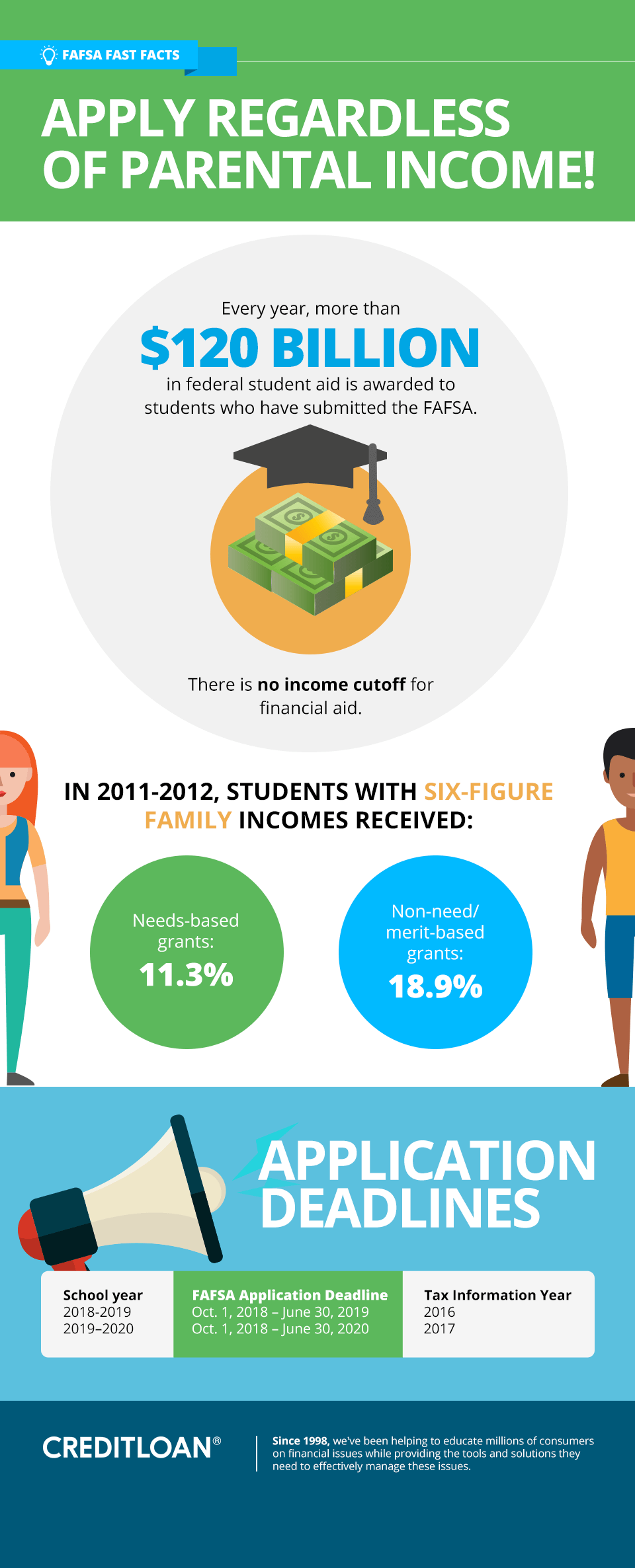

The Ultimate Fafsa Guide 2018 Creditloan Com

The Ultimate Fafsa Guide 2018 Creditloan Com

How To Make Your Assets Disappear On The Fafsa

What Is A Dislocated Worker On The Fafsa Frank Financial Aid

What Is A Dislocated Worker For Fafsa

Guide To Completing The Fafsa Ccac S Help Center

What Is A Dislocated Worker For Fafsa

Fafsa On The Web For Effective January 1 Ppt Download

How To Answer Fafsa Question 97 Dislocated Worker Status

Complete Guide On How To Answer Fafsa Questions Scholarshipowl